A Decrease in Business Taxes Will Tend to

A increase aggregate demand but not change aggregate supply. Our net exports will tend to decrease b.

Solved Question 9 1 Point Lower Taxes On Businesses Will Chegg Com

For instance if the business owner is a single person with small business he can buy a home in a good neighborhood for 100000 and pay off his mortgage.

. A Decrease aggregate supply and decrease aggregate demand. Decrease aggregate demand and increase aggregate supply. Increase aggregate demand and decrease aggregate supply.

Up to 256 cash back Get the detailed answer. A decrease in business taxes will tend toAIncrease aggregate demand but not change aggregate supply BIncrease aggregate supply but not change aggregate demand CIncrease aggregate demand and increase aggregate supply DDecrease aggregate supply and decrease aggregate demand AACSB. Up to 256 cash back A decrease in business taxes will tend to.

Increase aggregate demand and increase aggregate supply. An increase in the real value of stock prices which is independent of a change in the price level would best be an example of the. A decrease in business taxes will tend to.

Decrease in aggregate demand. An increase in aggregate demand is most likely to be caused by an increase in. A decrease in business taxes will tend to A increase aggregate demand and.

A decrease in business taxes will tend to. Low-income countries tend to have a higher dependence on trade taxes and a smaller proportion of income and consumption taxes when compared to high-income countries. A decrease in business taxes will tend to.

B increase aggregate supply but not change aggregate demand. O Increase aggregate supply but not change aggregate demand. The commerce world is usually subjected to constant changes and it is important to be up to date with the latest trends.

The tax system on the other hand is set by the government which means that even if the homeowner has no other income he will have to pay the full amount in order to keep his home. Flexible and resource prices are fixed. This will likely result in more money going to the government but it will likely also result in companies like Amazon Apple and Google to be forced to pay more so that they can keep the profits they make.

The Tax Foundations State Business Tax Climate Index enables business leaders government policymakers and taxpayers to gauge how their states tax systems compare. Answer- Option B increase aggregate. The intersection of the aggregate demand and aggregate supply curves determines the.

The interest rate will also tend to increase c. A decrease in business taxes will tend to. Change as the price level changes.

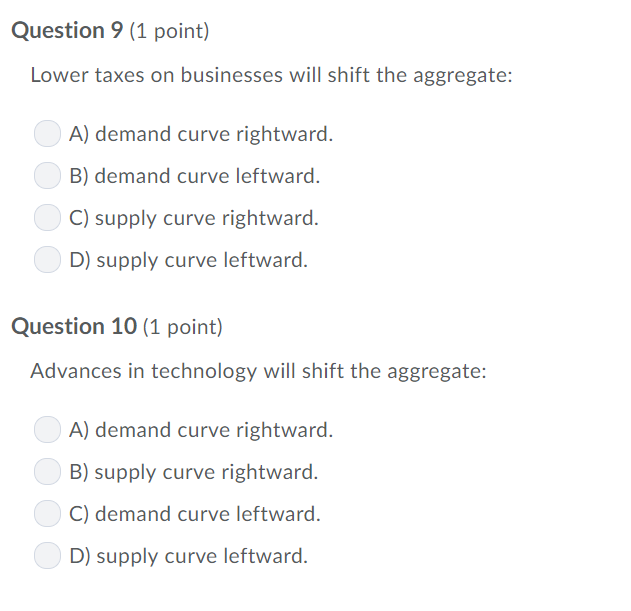

A decrease in business taxes will tend to. The short run version of aggregate supply assumes that product prices are. 45 A Decrease In Business Taxes Will Tend To 8 Decrease Aggregate Supply And Decrease C Increase Aggregato Supply But Not Change Aggregate Demand D Increase Aggregate Demand And Increase Aggregate A 103 47 The Lending Ability Of Commercial Banks Increases When Th Supply 46 With An MPS Of 03 The MPC Will Be S 103 C 03 D.

B Increase aggregate supply but not change aggregate demand. A decrease in business taxes will tend to. Increase aggregate demand and increase aggregate supply.

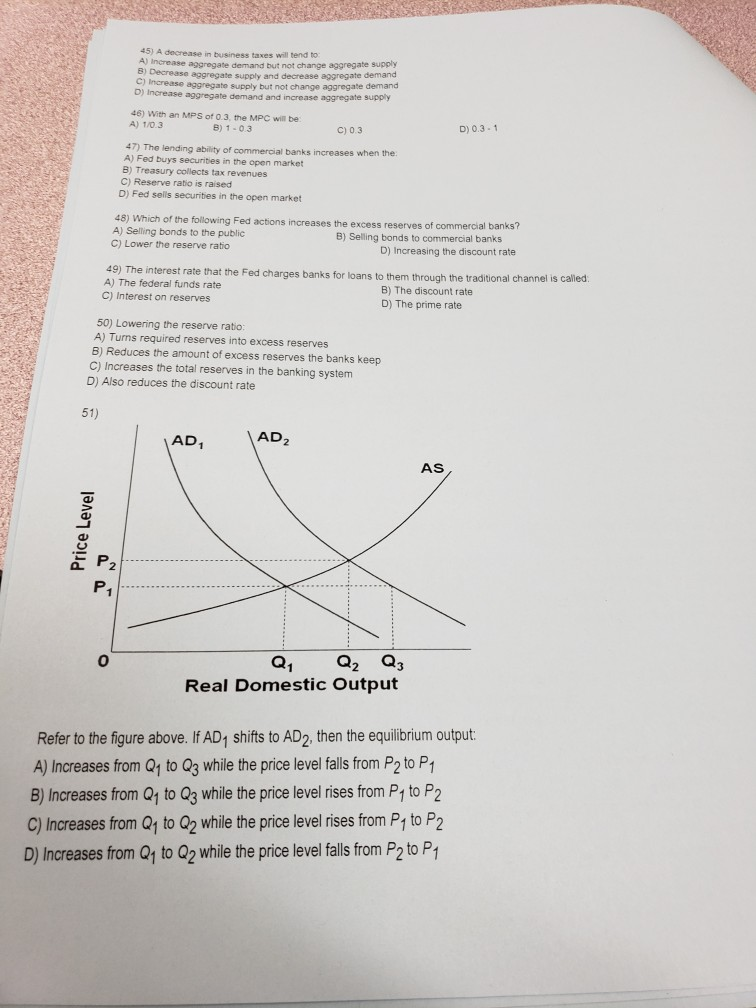

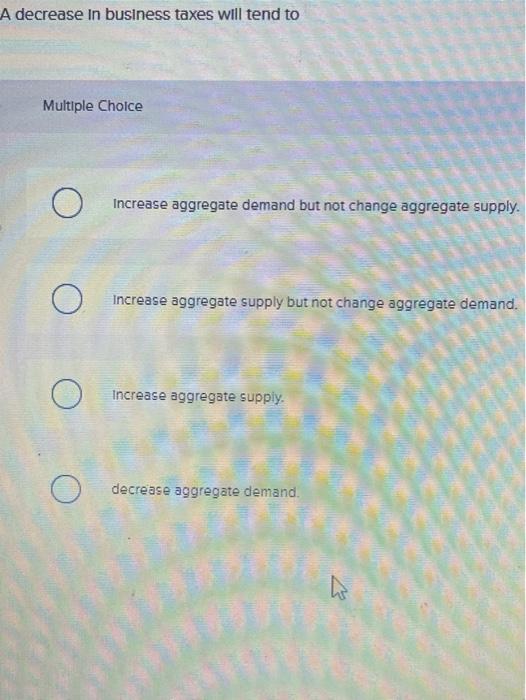

A decrease in business taxes will tend to Multiple Choice O Increase aggregate demand but not change aggregate supply. Course Title ECONOMICS 140. The IRS wants to increase the tax rate on the business side so that you can deduct more of your profits.

View the full answer. The purchasing power of peoples savings will increase. Increase aggregate demand but not change aggregate supply B.

With the advancement in technology it has become easier for entrepreneurs to get the latest information about their. Commerce Trends That Advertisers Need To Look Out For. Decrease aggregate supply and decrease aggregate demand.

Increase aggregate supply but not change aggregate demand. Decrease aggregate demand and aggregate supply. Level 3 Apply Difficulty.

D decrease aggregate supply and decrease aggregate demand. An increase in expected future income will. C increase aggregate demand and increase aggregate supply.

Increase aggregate demand but not change aggregate supply. Question 25 If personal income taxes and business taxes increase then this will. A decrease in business taxes will tend to.

A decrease in personal income tax rates will cause an. School California State University Sacramento. Increase aggregate demand and increase aggregate supply.

Increase aggregate demand and aggregate supply. The long run in macroeconomics is a period in which nominal wages. C Increase aggregate demand and increase aggregate supply.

Select oneCorrect 100 points out of 100 a. A decrease in business taxes will tend to a increase. Foreign buyers will buy less of our output and we tend to import more d.

Increase aggregate demand but not change aggregate supply b.

Solved 45 A Decrease In Business Taxes Will Tend To 8 Chegg Com

Solved A Decrease In Business Taxes Will Tend To Increase Chegg Com

Solved A Decrease In Business Taxes Will Tend To Multiple Chegg Com

Solved A Decrease In Business Taxes Will Tend To Multiple Chegg Com

0 Response to "A Decrease in Business Taxes Will Tend to"

Post a Comment